Transaction Reporting: Man vs. Machine

At this year's Regulatory Horizon 2022: Preparing for the Challenges of Tomorrow conference, we examined key governance, risk and compliance challenges that firms face in 2022, and beyond. A whitepaper has now been developed, capturing key takeaways and benchmarking polls from the event.

This blog features one of the nine chapters in the paper. Click here to view the full paper and access on demand recordings of panel sessions embedded throughout.

Overview

- Firms cannot rely solely on technology to create and submit complete and accurate reports under Markets in Financial Instruments Regulation (MiFIR), EMIR or Securities Financing Transactions Regulation (SFTR).

- Human involvement is needed as an overlay at every stage of the reporting process – from logic specification and technology configuration to exception management and monitoring. Many firms are struggling to find this balance and get their transaction reporting right, with high error rates still being seen.

Transaction reporting: man vs. machine

Financial firms struggle to get their MiFIR, EMIR and SFTR reporting right. ACA research shows that 97% of firms have reporting errors, 85% of reports feature an error, and on average firms have 30 different error types.

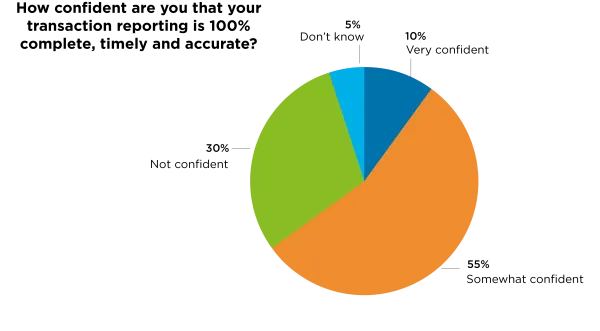

This backs up the messages we have seen from regulators over recent years around poor data quality and ineffective monitoring, it appears these concerns are now being heeded by firms, whose confidence in the quality of their data is on the decline. This year, just 65% were very confident, or somewhat confident in this statement, compared with 87% at ACA’s 2021 event.

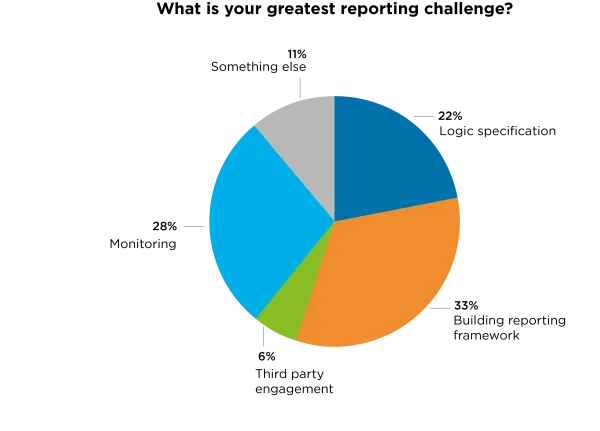

Firms struggling with getting some of the basics right, with one-third saying their greatest challenge is building a reporting framework.

While 28% said their greatest challenge is monitoring, 22% said it is logic specification.

Help through technology

While a small number of firms may continue to do their reporting manually, because they will trade just a few times a year, most firms now use some form of technology to assist with their reporting. But what is clear firms cannot just leave it up to the machines. Human intervention to ensure the reporting is being done correctly is essential to understand the different activities of the firm and how they should be reflected in reports, to specify the reporting logic and configure the technology based on that analysis, and to ensure controls are operating properly. Without this intervention, one small error can wind up being replicated thousands – or even hundreds of thousands – of times.

Firms also need to be sure their exception management processes are robust. Training, expertise, and good process among exception management staff are essential to ensure exceptions are handled in a consistent way each time, and that they are resolved correctly.

When it comes to reconciliation and monitoring, it’s not practical or meaningful for firms to do this in a manual way, or by sampling. Firms should be analysing all of the fields and all of the reports, to make sure the data is high quality – and remember that just because regulatory reporting passes validation, that doesn’t mean it’s correct.

Successful reporting therefore requires a hybrid approach of technology – to do the heavy lifting - and human expertise – to make sure that the technology is set up properly in the first place and operating as intended thereafter. This is an approach that has been explicitly recommended by the FCA in other areas such as market abuse surveillance and best execution monitoring, and the same principle applies here.

And yet, it’s clear that many firms are not doing enough, and in some cases not even covering the basics. In fact, last year, ACA submitted the Freedom of Information Act request to the FCA, which revealed around 3000 firms had the permission profiles to bring them in scope of MiFIR reporting, but only about 900 actually had access to the market data processor (MDP). In 2020, only around two-thirds of those firms actually requested data. Obtaining that data is an explicit requirement under RTS 22, so a failure to obtain it means a de facto breach as well as it being impossible for the firm to identify reporting errors nor furnish senior managers with confidence regarding the accuracy and completion of reports.

Managing change

Lastly, firms need to be sure that their technology systems can easily and quickly adapt to regulatory and business change, and that the teams managing reporting technology have been properly trained in how to make changes to the system. Changes increase the risk of reporting errors, and so need to be managed carefully, be it in terms of new personnel, new clients, the trading of different instruments, or the forthcoming EMIR Regulatory Fitness and Performance (REFIT) reporting changes.

The consequences of reporting errors are often considered only in terms of enforcement action and fines. Although the FCA’s self- proclaimed objective of becoming a ‘data-driven regulator’ means that it is a question of ‘when’ and not ‘if’ we see such enforcement actions being taken, firms would be wise to also consider the other effects of regulatory scrutiny, even where they do not lead to a fine. The costs of a section 166, of external counsel and consulting support and of remediation and back-reporting, as well as the management time and personal stresses that can all arise from that scrutiny should not be ignored.

On Demand Webcast

Click here to watch a recording of the panel discussion on which this article is based.

Questions?

Our specialists are on hand to help you to navigate these challenges while considering the complexity of your firm’s unique compliance, managed services, and ESG requirements.

In addition, our ESG advisory team are on hand to help you gain clarity on your ESG requirements and build a strong ESG program that meets incoming regulatory needs. This practice helps firms of all sizes develop and monitor ESG programs to mitigate risk, make informed choices, grow profitably and sustainably, and combat greenwashing in the process.

Complete this form or call +44 (0) 20 7042 0500 to connect with us.