Top Five Investment Performance Trends

In the dynamic world of investment management, adherence to the Global Investment Performance Standards (GIPS®) serves as a critical benchmark for transparency and credibility. ACA recently conducted a survey of 700 GIPS compliant firms to learn more about performance calculations, concerns, and other hot topics within the investment management industry.

The results are broken down by firm type:

- Wealth firms: defined as those firms with $1B or less in AUM

- Core firms: defined as those firms with $1B - $50B in AUM

- Diversified firms: defined as those firms with over $50B in AUM

The survey revealed several notable trends and practices across the industry. Here are the top five trends that were noted and their implications.

1. The SEC Marketing Rule

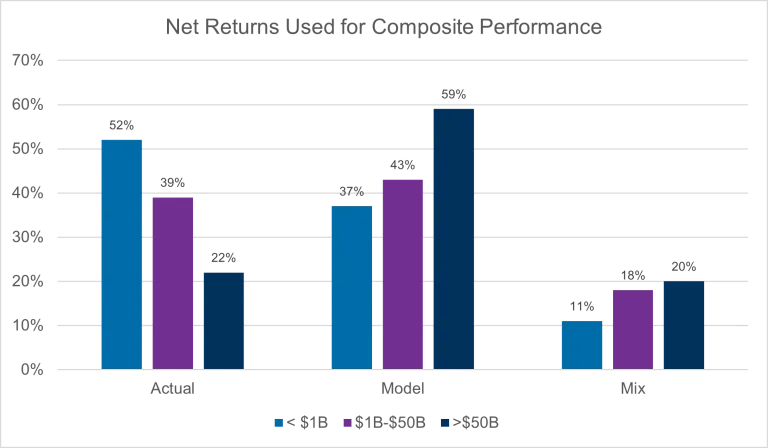

As firms continue to reconcile the implications of the U.S. Securities and Exchange Commission’s (SEC’s) Marketing Rule with long held practices, we continue to see differences in the treatment of net-of-fee calculations and reporting practices between wealth and diversified firms. Wealth firms predominantly use actual fees (50%), whereas diversified firms lean towards model fees (60%). More recently in a follow-up survey, 50% of the firms that were questioned, are using a highest potential fee when calculating net-of-fee performance.

The recent SEC Risk Alert published earlier this year noted that using lower fees than offered in calculations for net-of-fee performance could be considered misleading performance claims. Since the publishing of that Risk Alert, a majority of firms (62%) have updated their current practices for calculating net-of-fee performance.

A noteworthy finding from this survey is the limited adoption of net returns in contribution to return disclosures among surveyed firms. This raises considerations regarding reporting practices and whether to include this information as a note given the prevalent status quo and minimal changes observed.

2. Performance system changes

Approximately 20% of firms across the board have changed their performance systems in the past five years. Looking ahead, 15% of firms anticipate their next significant change to be related to system upgrades. This reflects ongoing technological evolution within the industry, driven by the need for enhanced efficiency and compliance capabilities. To help alleviate the concerns and difficulties around performance systems, ACA has seen an uptick in firms that outsource this key duty to experts that know the intricacies of performance calculation and offer the necessary customization capabilities and flexibility that most standalone systems lack.

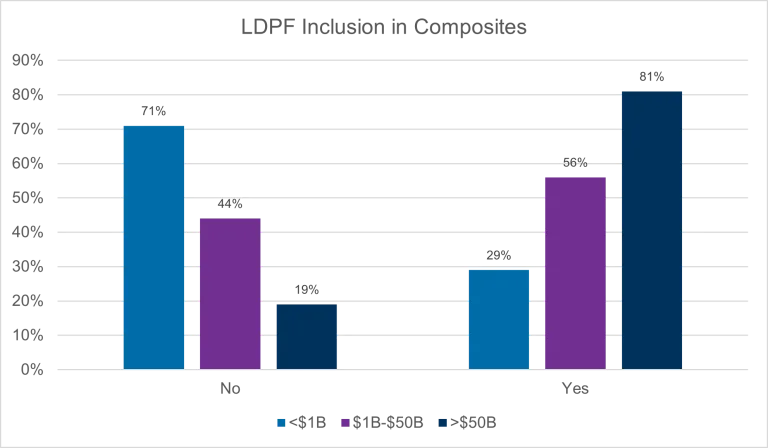

3. GIPS compliance for funds

The survey reveals a stark contrast in composite inclusion practices of limited distribution pooled funds (LDPFs) between wealth firms and diversified firms. While 70% of wealth firms opt not to include LDPFs in composites, a substantial 80% of diversified firms do include funds. These results show that there is no consensus among the varying types of firms in the industry on how to treat these private assets within a GIPS framework. However, recently regulators have started to focus more closely on the level of transparency required from these firms when presenting to investors.

This regulatory scrutiny surrounding private funds and the demand for greater transparency will remain one of the prevailing themes in the financial industry. Although less stringent than the proposals of the recently overturned Private Fund Adviser Rule, the Institutional Limited Partners Association (ILPA) plans to continue its efforts on template reports that emphasize fee transparency and strive to increase representation of the interests of institutional investors in the private equity sector.

4. Responsibility for GIPS compliance

The responsibility for GIPS compliance varies depending on the firm size, but according to the survey, the operations team typically holds primary oversight. However, the survey also showed the importance of firm-wide buy-in, emphasizing that GIPS compliance should not be solely relegated to one department. Cross-functional collaboration ensures comprehensive oversight and adherence to standards across all parts of the firm. Larger firms tend to establish oversight committees for GIPS compliance, whereas smaller firms often do not. The composition of these committees varies but typically includes representatives from key operational and compliance functions. This structured approach supports robust governance and ensures adherence to regulatory requirements.

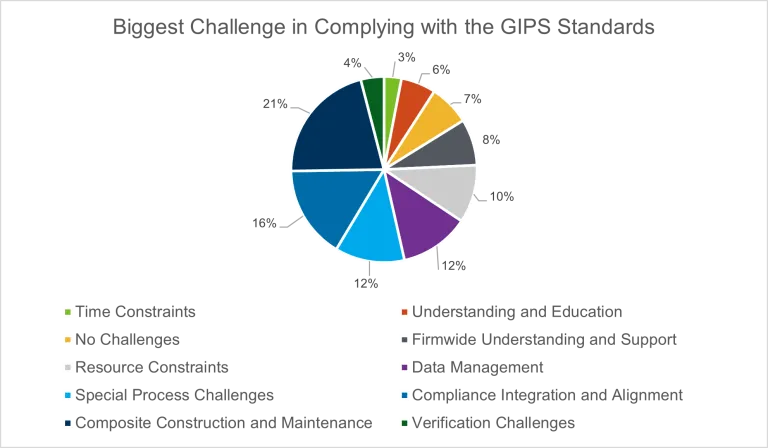

5. Biggest challenges

The survey identifies several challenges faced by GIPS compliant firms prominently centered around data management and resource constraints. The following emerge as critical areas requiring attention and innovative solutions:

- Composite construction and maintenance

- Compliance integration and alignment

- Outlier review processes

Outsourcing and leveraging the latest technologies could assist firms in alleviating the burdens associated with staff turnover, attrition, and difficulties related to data management.

Conclusion

The insights gleaned from this survey underscore the nuanced landscape of compliance, operational practices, and regulatory adaptations within the investment management industry. As firms navigate evolving standards and regulatory frameworks, strategic alignment and technological readiness will be pivotal in maintaining a competitive edge and credibility. By addressing key challenges and embracing best practices, GIPS firms can enhance transparency, bolster investor confidence, and foster sustainable growth in a complex global market environment.

How we help

We are the only governance, risk, and compliance (GRC) firm that offers both regulatory compliance advisory and performance expertise, including a deep understanding of the intricacies of complex performance calculation methodologies. We can assist your firm with overcoming the challenges uncovered in the survey. Our services include:

Firm-wide verification: Independent verifications designed to assess whether your firm is adhering to the GIPS standards. These verifications confirm:

- Whether your firm has complied with all the composite-construction requirements of the GIPS standards on a firm-wide basis

- Whether your firm’s processes and procedures are designed to calculate and present performance results in compliance with the GIPS standards

Focused review: Review of your calculations to ensure that the methodology used was applied consistently and in-line with the SEC Marketing Rule.

Managed performance services: Outsource all or certain aspects of your performance measurement and reporting functions with the assurance that you are working with a team that not only understands the technical aspects of calculating complex performance, but also knows industry best practices and regulatory expectations.

Reach out to your ACA consultant or contact us here to learn how we can help with your investment performance calculations.