SEC Chairman Gensler Signals an Increase in Scrutiny & Regulation of Private Markets Fund Industry

Under the stewardship of Chairman Gary Gensler, it is widely expected that the U.S. Securities and Exchange Commission (SEC) will significantly increase its scrutiny of, and evolve its regulatory agenda relating to, private markets fund managers. He recently signaled such intent on May 26, 2021 in his testimony before the Subcommittee on Financial Services and General Government, U.S. House Appropriations Committee. Chairman Gensler honed in on the significant increase in the private equity and venture capital fund industry over the last 5 years.

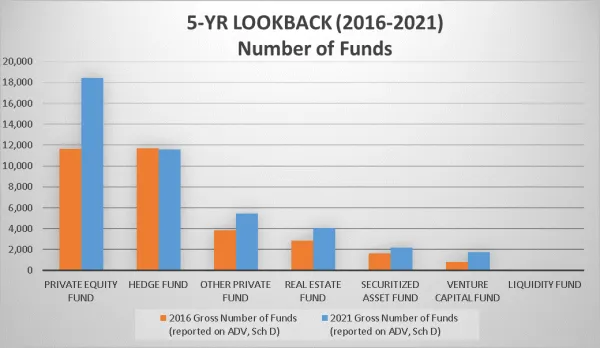

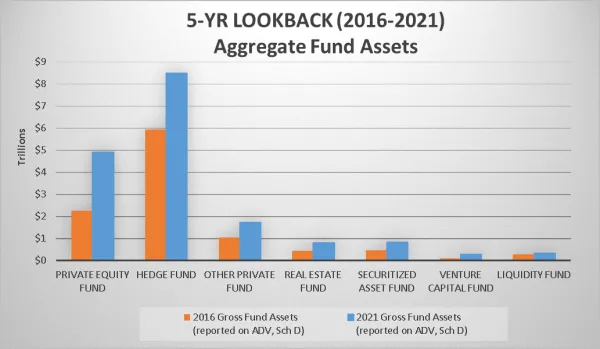

Chairman Gensler went on to note that there are currently more than 18,000 private equity funds, a 58 percent increase over the last five years. Meanwhile, during the past 5 years, the number of venture capital funds increased by 110 percent, to more than 1,700 funds. See Figure 1 below. He added that the size of private equity and venture capital funds has also grown over this 5-year period, with reported gross fund assets increasing by 116 percent in private equity funds and close to 200 percent in venture capital funds over that period. See Figure 2 below.

Figure 1

Figure 2

Source: https://www.sec.gov/news/testimony/gensler-2021-05-26

In the foregoing testimony, Gensler stated that the private markets industry is not only growing, but also evolving to encompass new strategies, structures, conflicts and business practices, which creates new risks for the markets and investors. He noted that in light of such significant growth and evolutions, he has asked his staff for their recommendations in the areas of enhanced reporting and disclosure through Form ADV and Form PF, as well as other possible reforms to the regulation of private markets fund managers.

Although we have not yet seen a material uptick in SEC enforcement activity under Chairman Gensler, in light of numerous recent indicators that a storm lies ahead, now would be an ideal time for private markets fund managers to take stock of lessons from past SEC enforcement themes and trends, which are likely to cyclically repeat into the future, and close the gap on any inadequacies in their compliance programs (and/or implementation of such programs).

Download our Private Markets Quarterly Update

This is just one of the many insightful articles included in our Private Markets Quarterly Update 2021 Q3. Download the full newsletter to learn about:

- Chairman Gensler Signals an Increase in Scrutiny & Regulation of Private Markets Fund Industry

- Noteworthy Recent Trends in SEC Examinations and Enforcement Actions

- How Does Recent Guidance on Principal and Cross Trades Apply to Real Estate and Private Equity Advisers?

- Compliance Considerations for Fund Managers Sponsoring SPACs

- The FCA Clears the Way for Potentially Greater SPAC Issuance

- A Practical Guide to Marketing Investment Performance Under the SEC’s New Marketing Rule

- Practical Tips on How Private Fund Managers Can Enhance their Side Letter Management Processes Amidst Increase in Regulatory and Investor Scrutiny

- Notable Industry Developments

- EU Cross Border Fund Distribution Directive and Regulation - Raises More Questions than it Answers?

- Cybersecurity Developments

For more information

The Private Markets Team is available to discuss ways in which ACA may be able to assist you in meeting your compliance, corporate governance, risk management and operational objectives for 2021. Contact the Private Markets Team to schedule your discussion.