Now Batting: The SEC's Form N-CEN with Two on Deck

As of June 1, 2018, registered investment companies (“funds”) are required to file Form N-CEN with the U.S. Securities and Exchange Commission (“SEC”) on an annual basis. This new form replaces the semi-annual census reporting on Form N-SAR and must be filed within 75 days of a fund’s fiscal year end (with an exception for unit investment trusts, which must file within 75 days of calendar year end).

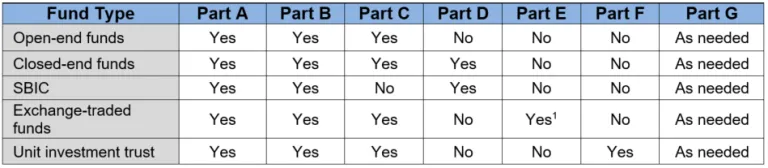

Form N-CEN is broken into seven parts, as illustrated below:

The SEC staff noted in revised FAQs that funds with fiscal year-ends of October 31 or November 30, 2018, do not need to complete a semi-annual Form N-SAR filing for the mid-year periods ending April 30 or May 31, 2018.

Keep in mind, however, that the compliance dates for filing the required liquidity information on Form N-CEN is December 1, 2018, for larger fund groups and June 1, 2019, for smaller fund groups.

In addition to completing the new form, funds should look to update their policies and procedures to incorporate the new form along with the next two forms in the filings lineup.

On Deck: Forms N-PORT and N-LIQUID

Beyond Form N-CEN, funds must continue to prepare for new Forms N-PORT and N-LIQUID. Form N-PORT, which will eventually fully replace Form N-Q, is a monthly filing made with the SEC within 30 days of month-end. Given the form’s requirement for detailed portfolio data, cybersecurity issues with the SEC’s EDGAR database, and the tie-in with the investment company liquidity risk management program rule, the initial filing date for Form N-PORT has been pushed back to 2019 for larger fund groups and 2020 for smaller fund groups. However, there’s a catch: beginning June 30, 2018, larger fund groups must maintain in their records the information required by Form N-PORT (minus liquidity information) even though filing with the SEC is not required for another year.

Form N-LIQUID is a new form tied directly to the liquidity risk program rule. Filed confidentially with the SEC, the form notifies the SEC (i) when a fund’s level of illiquid investments that are assets exceeds 15% of its net assets, (ii) when such assets are deemed to have changed to be less than or equal to 15% of net assets, or (iii) when a fund’s highly liquid investments that are assets fall to or below the fund’s highly liquid investment minimum for more than seven consecutive calendar days. Form N-LIQUID must be filed within one business day of the occurrence of such events. The compliance dates for filing the form, with regard to illiquid assets, are December 1, 2018, for larger fund groups and June 1, 2019 for smaller fund groups. The compliance dates for filing information concerning the highly liquid investment minimum are six months later, respectively.

About the Author

Erik Olsen is a Managing Director at ACA. Erik focuses on the mutual fund industry, providing ongoing and customized regulatory compliance consulting and compliance program review services to registered investment companies, their investment advisers and sub-advisers, and other service providers. Erik joined ACA in 2012 as a Senior Principal Consultant.

Prior to joining ACA, Erik was a Compliance Director at Legg Mason. In that role, he headed the firm’s Global Compliance Examinations team, overseeing compliance program and risk control reviews of Legg Mason’s worldwide investment advisory affiliates and distribution units.

Before Legg Mason, Erik served as a Securities Compliance Examiner in the U.S. Securities and Exchange Commission’s Office of Compliance Inspections and Examinations (Investment Adviser/Investment Company) where he conducted regulatory examinations of registered investment advisers and registered investment companies. At the SEC, Erik helped launch the CCO Outreach Program. In 2005, he received the Chairman’s Award of Excellence.

Erik is a Certified Fraud Examiner. He earned his Bachelor of Business Administration degree in Finance from Loyola College (now Loyola University Maryland).

1 If the exchange-traded fund has been established as a unit investment trust, it will be required to complete Parts E and F.