Mobile Communication Capture: Navigating the Landscape of Governed vs. Native Solutions

As mobile communication becomes the dominant medium for business, the need for robust mobile capture solutions has never been greater. There are two common approaches to capture:

- Governed Mobile Capture assigns a secondary number to an employee’s device, used solely for business communications. Employees access an app to send business messages, ensuring separation between personal and work-related content. This approach is most effective when firms operate under a Bring Your Own Device (BYOD) policy, allowing employees to maintain privacy for personal messages. However, a key risk is that employees might neglect to use the app, leading to off-channel communications that are not captured. As a result, we’ve seen a resurgence of corporate phones to mitigate this risk.

- Native Mobile Capture connects personal or corporate devices directly, capturing all business communications seamlessly without the need for an additional app. This method simplifies compliance and has grown in popularity, especially as firms transition back to the office post-pandemic.

Mobile capture trends

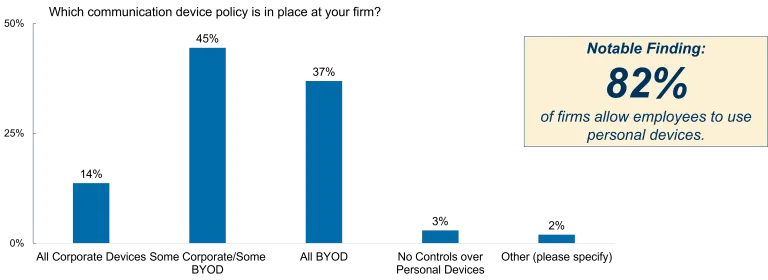

During the pandemic, many firms moved away from using corporate phones and relied solely on personal devices. However, with increased scrutiny from regulators such as the U.S. Securities and Exchange Commission (SEC), particularly around off-channel communications, firms are once again turning to corporate phones for simplicity and compliance. According to the 2024 Investment Management Compliance Testing Survey, nearly 60% of respondents relied either solely on corporate devices (14%), or a combination of Corporate Devices with BYOD (45%).

How we help

ACA’s ComplianceAlpha eComms Technology Solution is empowering firms to enhance their Digital Communications Governance (DCG) by continuously expanding the channels we capture. With ACA’s deep expertise and white-glove onboarding approach, we’re revolutionizing DCG through enhancements to our eComms Archive and Surveillance technology.

In 2024, we’ve expanded our capture capabilities in the mobile, social media, and financial collaboration spaces, offering financial firms more flexibility and security in their compliance efforts.

Reach out to your ACA consultant, or contact us here to learn how we can help you meet your books and records requirements and launch, grow, and protect your firm.