ILPA's Revised Reporting Template for the Private Equity Industry

The Institutional Limited Partners Association (ILPA) released a new version of the ILPA Reporting Template on January 22, 2025 to improve transparency with the increasing complex investment structures.

What is the ILPA Reporting Template?

The template was initially developed in 2016 to “promote more uniform reporting practices in the PE industry related to fees, expenses and carried interest, representing a step forward in enhanced transparency in these areas, which are critical to supporting the alignment of interest and partnership between General Partners (GPs) and Limited Partners (LPs).” The template has experienced incremental updates throughout the years to reflect changes in accounting standards, expanding of data fields, and allowing for technology integration. This latest update marks a 2.0 version with broader changes to address LP requests.

What is the significance of this version?

ILPA initially launched a committee in 2024 to collaborate across the industry with stakeholders from LPs, GPs, Fund Administrators, and Consultants with a goal of incorporating the now vacated U.S. Securities and Exchange Commission (SEC) Private Funds Adviser Rules requirements for Quarterly Statements within the existing reporting framework. Once vacated the committee was able to focus on a shared goal to develop the new ILPA Reporting Template that considered industry feedback, current fee and expense reporting, and performance trends. This renewed collaboration and lack of tether to a rigid SEC rulemaking paved the way for the now 2.0 ILPA Reporting Template that includes a new performance template.

In some cases, LPs require ILPA reporting as part of quarterly reporting packages. Due to the broad nature of contract language, a GP may find that they are subject to providing the newer report, which now includes a performance component.

What is included in the new template?

The performance template includes:

- Total fund LP cash flow details - including date, amount, and description for impacts to net

- Total fund level performance - both with and without the impact of a subscription facility

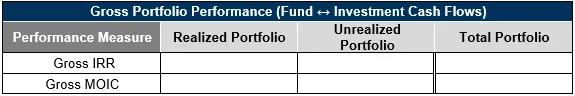

- Portfolio level realized, unrealized, and total gross investment rate of returns (IRRs) and multiple on invested capital (MOICs)

This new performance template recommended two varying options, a ‘granular’ and ‘gross up’ version, for the calculation of performance. The creation of multiple methodologies acknowledges that the level of data managed across asset classes may make one methodology better suited for one fund over another.

The ILPA Reporting Template 2.0 fee and expense report looks to incorporate some of the concepts that existed in the SEC’s Private Funds Adviser Rules requirements for Quarterly Statements. This includes disclosure on fee rebates, waivers, and offsets as well as more granularity around expenses allocated or paid to related persons.

When does the new template take effect?

ILPA intends for the updated Reporting Template to replace the existing template on a go-forward basis for funds still in their investment period during the 1Q 2026 period, or any funds commencing operations after January 1, 2026. GPs should communicate with their LPs to understand how and if they are expected to implement the new template.

How we help

ACA is the only GRC firm that combines regulatory compliance expertise with deep investment performance knowledge, making us uniquely positioned to assist firms navigating complex performance calculations, including the new ILPA Reporting Template. We offer several solutions to support this transition:

- Gap analysis: Assessing the impact of ILPA’s new requirements on your firm’s reporting and providing tailored recommendations.

- Managed performance services:

- Private fund reporting support: Our services extend to supporting private fund reporting and ILPA reporting, helping firms align performance metrics with investor expectations and industry best practices across private funds and liquid funds.

- Task-based solutions: Providing targeted support for performance calculations, composite management, custom track record creation and maintenance, generating performance data for marketing materials, fee calculations, risk metrics analysis, and staff augmentation.

- Focused review: Ensuring IRR calculations are applied consistently and align with ILPA’s reporting template.

Whether you are looking to launch, grow, or protect your firm, we can help you enhance accuracy, improve efficiency, and mitigate risk while streamlining your investment performance processes. Contact us to start a conversation with us today.