Highlights from ESG and the Year Ahead

Following the launch of ACA’s environmental, social, and governance (ESG) advisory practice, our webcast ESG and the Year Ahead recently discussed ESG trends and how to better address sustainability and responsible investing issues in the year ahead. Summarized below are four themes to consider throughout this year as you build out and enhance your ESG program.

Regulatory Developments in the U.S. and European Markets

- In the U.S., the groundwork has been laid for a major shift in climate policy with President Biden recommitting to the Paris Climate Agreement immediately following his inauguration and committing to carbon-free electricity by 2035, and a net-zero economy by 2050. To help realize these goals he brings with him the largest-ever team of climate experts to the White House.

- The EU’s Sustainable Financial Disclosure Regulation (SFDR) Level 1 requirement will come into effect on March 10th of this year. This would require “comply or explain” public disclosures at the firm and product level for those in scope – however, the disclosures tie into longer-term considerations related to more robust requirements under SFDR which will come into effect within the next year or so.

- The U.S. Securities and Exchange Commission’s (SEC) ESG sub-committee has recommended that the SEC adopt ESG disclosure standards at both issuer and investment product levels. It is therefore likely that the SEC will focus on ESG during the 2021 exam period.

- The Department of Labor (DOL) removed reference to ESG in the revised draft of the Employee Retirement Income Security Act (ERISA) following stakeholder opposition to the new language. The revised language is ambiguous and, in light of the change in administration, is likely to be modified or rewritten.

- Newly appointed Treasury Secretary Janet Yellen has emphasized the importance of addressing climate change through the financial system.

Updates to Leading Voluntary Frameworks

- The Principles for Responsible Investing (PRI) reporting framework underwent a major overhaul late last year, with the new framework focusing more on how signatories integrate ESG into the investment process. The new framework includes several mandatory/scored questions on climate change and sustainability outcomes, as well as a voluntary module on sustainability outcomes. The assessment methodology, or scoring, has also changed, making it impossible to compare scores from prior years.

- Various voluntary frameworks recognize the need for standardization among voluntary frameworks and have been collaborating on harmonization efforts. This includes the World Economic Forum’s efforts (along with Deloitte, EY, KPMG and PwC) at developing universal reporting metrics and disclosure and SASB, GRI, CDP, CDSB and IIRC’s shared vision for a comprehensive reporting system.

- CFA Institute is developing an ESG Disclosure Standard to be applicable at the investment product level and aimed at promoting transparency and consistency through a standardized disclosure framework. The draft standards are expected to be released for stakeholder comment in May 2021.

Predictions for the Year Ahead

- Given the massive ESG commitments made in 2019-2020, we believe 2021 will be a year of great implementation, with firms looking for solutions to operationalize their commitments; this includes greater adoption of TCFD recommendations and scenario planning around potential carbon regulation.

- Climate Change and Diversity, Equity & Inclusion (DE&I) will be the top engagement areas of focus in stewardship priorities.

- More firms will turn the lens on themselves to better understand their performance on various ESG topics at the firm level.

- Acceleration of the low-carbon energy transition through investment in clean energy infrastructure, a move away from fossil fuel investment, and scaling-up of clean technologies including carbon capture and sequestration.

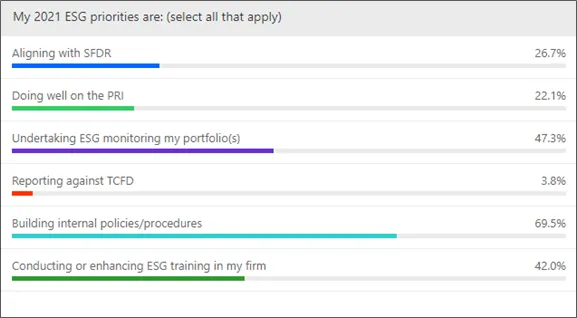

2021 Investment Manager ESG Priorities

During the webcast, we polled the audience to identify top ESG priorities for 2021. An interesting takeaway from the results of this question is the low percentage of attendees (3.8%) who have TCFD reporting as a priority for the year ahead. Given the increasing relevance of this framework with the U.S.’s re-entry to the Paris Agreement and a climate-focused regulatory agenda, many firms clearly underestimate the impact and relevance of TCFD reporting. We intend to deliver content specifically on TCFD reporting in the near future to promote better understanding of the recommendations and how to start incorporating carbon foot-printing and climate scenario analysis into your ESG program. To keep up to date on ESG insights and events, please subscribe to our mailing list and select ESG.

Additional Resources

Webcast: ESG and the Year Ahead

Meet ACA's ESG advisory specialists, Dan Mistler, Partner, Crista DesRochers, Partner, and Dani Williams, Principal Consultant, to discuss ESG trends and how to better address sustainability and responsible investing issues in the year ahead.

Questions?

If you have questions for us on any of the topics highlighted here and how we can help you, please reach out to our ESG advisory team to request a meeting.