Foreign Withholding Tax Leakage and ETF Performance Implications

The sea of competition for ETFs is growing deeper

The ETF space has grown exponentially in recent years; at the end of 2021, the collective assets under management of U.S. ETFs reached an all-time-high of $7.21 Trillion, marking a 31.9% increase from 2020. This, matched with the annual net inflows equating to a record $919.78 Billion, indicates that the demand for ETF investment has never been higher.

As the market grows, ETF managers must seek new ways to remain competitive amongst the array of options available to institutions and individuals seeking to diversify their portfolios. One of the crucial considerations for the discerning customer when selecting an ETF is fund performance, yet in many cases ETF managers are foregoing the opportunity to maximize fund performance and return-on-investment for their investors as a result of suffering preventable foreign tax.

This article highlights how understanding the complexities of foreign withholding tax (WHT), its implication for EFT performance, and the methods of reclamation and relief available to U.S.-domiciled ETFs could be a significant factor in remaining competitive amongst other funds.

Withholding taxes explained

When an ETF domiciled in the U.S. receives dividends or interest from a foreign security or ADR, up to 35% of the income can be withheld by the tax authority of the investment jurisdiction.

ETFs are entitled to a partial or full refund of this tax suffered, depending on the security and investment jurisdiction, and can utilize the following three reclaim methodologies to reduce their WHT exposure:

- Double taxation treaties (DTT) between the U.S. and the country of investment can be applied to reduce the WHT rate from the statutory rate to the double-tax treaty rate. These claims are available from all jurisdictions where a double tax treaty is in place between the U.S. and the investment jurisdiction.

- Domestic tax exemptions (DTE) that form part of the foreign investment jurisdiction’s legislation can be applied to reduce the WHT rate. Certain countries afford particular investors or fund structures favourable tax treatment.

- European Court of Justice (ECJ) claims can be filed for certain European investments based on the principle of the free flow of capital and discrimination between local and foreign investors. These claims can be submitted by EU and non-EU Investors including US ETFs and reduce the WHT rate to 0%.

It is worth noting that all three reclaim mechanisms are available to U.S. investors that invest offshore directly and via ADRs.

The reason that withholding tax leakage is a common issue

The reclaim process can be fraught with administration, back-and-forth with foreign tax authorities, and often requires knowledge of local tax legislature and fiscal representation within certain foreign markets. As a result, recoveries are often filed incorrectly or incompletely and rejected by the tax authority.

Furthermore, the method by which ETFs can fully reduce their foreign withholding tax rate down to 0% is via ECJ claims. ECJ claims are complex claims based on legal precedent and require detailed comparability analyses. Therefore, when ECJ claims are not filed, or filed incorrectly, investors can miss out on millions in dividend income.

A practical example

Considering all the operational, technical, and administrative challenges of the recovery process, it is commonplace that WHT leakage occurs. However, most investors are unaware of the significance of this leakage on a fund’s performance.

The below case study utilizes data from WTax, a WHT recovery specialist. It highlights the implication on fund performance for ETF managers that have utilized a WHT recovery specialist to minimize their WHT leakage.

Case study of 20 ETFs — powered by WTax's data

Using data from a sample of 20 ETFs serviced by WTax, with an average AUM of $560M, it was identified that using a WHT recovery service provider resulted in an average increase in performance of 11 basis points.

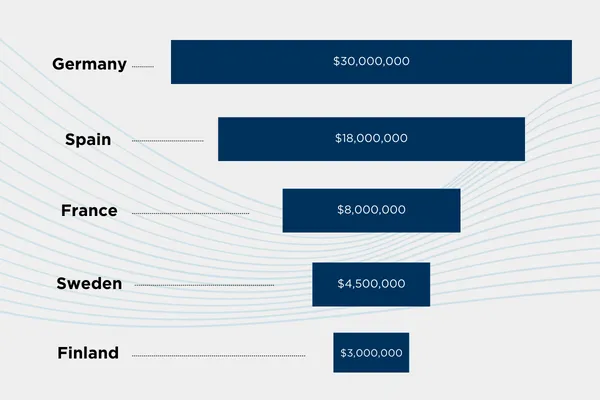

Additionally, WTax identified and submitted a grand total of $65m of WHT reclaims across the 20 sample ETFs. Of the value identified, the greatest amounts were submitted to the following territories:

In many cases an existing recovery agent had serviced the analyzed funds, with WTax identifying recoverable value over and above the work done by the incumbent provider.

The bottom line

At a time where ETF Managers are working with tight margins and leveraging ways to improve performance, it is pivotal to perform an audit of existing WHT leakage. Based on WTax’s data, utilizing an external recovery specialist could result in a material inflow of additional dividend income and increased fund performance, a factor which could tip the scales in making your fund more desirable than that of your competitors.

Therefore, if you are an ETF manager that holds foreign securities or ADRs, it is recommended that you get in touch with a WHT specialist to provide you with the full picture in terms of your WHT position, and guidance on the optimum method by which to minimize tax leakage and maximize investment performance.