The CFA Institute Finalized Guidance Statement for OCIO Portfolios

The CFA Institute released the Global Investment Performance Standards Guidance Statement for OCIO Portfolios on December 10, 2024 to help Outsourced Chief Investment Officer (OCIO) firms claim compliance with the Global Investment Performance Standards (GIPS®).

Any firm claiming compliance with the GIPS standards while managing one or more OCIO portfolios must adhere to the Guidance Statement for OCIO Portfolios. The new requirements become effective December 31, 2025, giving firms a year to ensure alignment with the new guidance.

Background

Recognizing OCIO firms often encounter obstacles claiming GIPS compliance, the CFA Institute formed an OCIO working group of industry participants in 2023 to gather insights and identify the challenges OCIO firms face when trying to present performance under the existing GIPS standards framework. The CFA Institute then published an Exposure Draft of the Guidance Statement for OCIOs in September 2023 incorporating feedback from the working group. After reviewing numerous comment letters, the group has now finalized guidance to make it easier for OCIO firms to claim GIPS compliance.

OCIO definition

The definition of an OCIO portfolio has remained largely unchanged from draft to final guidance, with two notable differences. The reference to “institutional investors” has been revised to “asset owners,” and a section has been added to clarify that the Guidance Statement does not apply to portfolios managed for retail clients. This clarification should come as a relief to wealth managers managing multi-asset portfolios for retail clients.

The definition has also been streamlined, removing several previously listed characteristics. It now succinctly states that an OCIO provides both strategic investment advice and investment management services to OCIO portfolios of asset owners, such as pension funds, foundations, and endowments.

| Applies | Does not apply |

|---|---|

| Portfolios for which the firm provides both strategic investment advice and investment management services | Portfolios for which the firm does not provide both strategic investment advice and investment management services |

| Portfolios where not all asset classes are included | |

| Portfolios managed for retail clients | |

| UK pension schemes |

Additionally, the draft guidance originally included a table that listed typical responsibilities of an OCIO, but this has been removed in the final guidance. A new section titled “Discretion Considerations” has been introduced. This section clarifies that investment advice provided by the OCIO often requires client approval, but typically the OCIO is given full discretion over the management.

For an OCIO portfolio to be discretionary, the firm must demonstrate that its investment decisions have been implemented on a timely basis. OCIO firms already claiming compliance will need to review their discretionary policy and ensure it fits within the new framework.

Key changes between the draft and the final guidance statement

Required composite structure

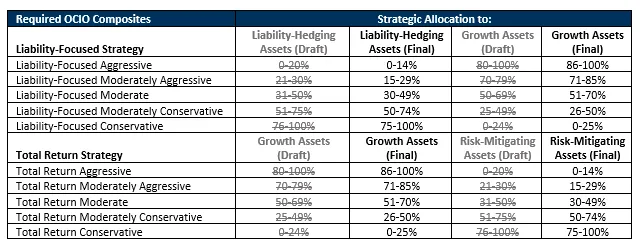

The mandated composite structure sparked significant debate and criticism in the guidance statement comment letters. This shift from the traditional GIPS standards framework, which allowed firms to choose their own composite structures based on a principles-based approach, is quite surprising. However, the OCIO working group remained committed to establishing a required structure for OCIO portfolios.

The CFA Institute did, however, take into account some suggestions to adjust the thresholds for the composites, particularly to more accurately reflect the Moderately Aggressive Composite, which features a broader range and includes the 80/20 allocation.

Asset class recommendations

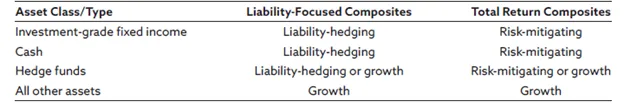

The final guidance allows each firm to classify asset classes on a composite-specific basis. However, rather than requiring firms to disclose the classification of each asset, they only need to report how they are treating hedge funds since the guidance statement has no recommendation for hedge funds, and if any other classifications differ from those outlined in the table below.

Firms looking to claim GIPS compliance should begin to classify their assets now into these categories and determine if they want to make any changes to these classifications.

Fee schedule disclosures

In the draft guidance, there was an example disclosure that included a table on all underlying investment fees for internal and external funds, which included the asset class, underlying fee, and description. This example was dropped in the final guidance. The only requirement is that the firm disclose the OCIO management fee, the types of fees that are earned on proprietary funds (e.g., investment management fees, performance-based fees), and any other fees that are earned, such as placement fees earned on proprietary funds or third-party funds.

The example provided for a firm that uses proprietary funds has a basis point disclosure for the fee schedule and a range for the approximate amount of fees from proprietary funds annually. The sample disclosure for a firm that uses primarily external funds only has a basis point disclosure for the management fee and a description that the firm earns placement fees on certain third-party funds.

Additional disclosures

A new requirement that was previously not captured within the draft is the disclosure of the actual asset allocation in the composite as of each calendar year end beginning with December 31, 2025. For liability-focused composites, firms must present the percentage of composite assets represented by growth assets and risk-mitigating assets. For total return composites, firms must present the percentage of composite assets represented by growth assets and risk-mitigating assets. Firms must also present the percentage of composite assets represented by private market investments and hedge funds as of each annual period ending on or after December 31, 2025.

There are a number of recommended disclosures regarding composite constituents, including the types of portfolios included, the funding ratio, the duration, the ranges of private equity assets, and more. These were all most likely added due to the comments received regarding the variability of OCIO portfolios in a composite.

Next steps for OCIO firms

The upcoming changes present both challenges and advantages. For OCIO firms already compliant with GIPS standards, these changes will require a reassessment of current processes to ensure they align with the updated standards. However, they also offer OCIO firms an opportunity to strengthen their market position and enhance credibility.

A recent FundFire article highlights this shift, quoting third-party evaluators (TPEs) who plan to make these standards mandatory. Non-compliant OCIO firms who find themselves in a position where compliance is compulsory will need to assess the impact and feasibility for their business. Achieving compliance signals a commitment to transparency and best practices, which can be a powerful draw for institutional clients.

Join our webcast to learn more

Join us for a live webcast on January 7, 2025 when our experts will explore the details of the guidance statement and its implications for OCIO firms. Register here

How we help

Navigating the complexities of the new OCIO Guidance Statement and ensuring GIPS compliance can be challenging for firms, especially given the recent updates. We offer a comprehensive suite of services designed to help OCIO firms address these evolving requirements with confidence.

- Composite maintenance and calculation outsourcing: We can manage the entire GIPS compliance process, including composite maintenance, data validation, and GIPS standards’ reporting, enabling your team to focus on strategic priorities while we handle compliance with precision and efficiency.

- GIPS standards gap analysis: We can conduct a detailed assessment of your investment performance framework, identifying gaps specific to the GIPS standards and OCIO Guidance Statement while providing actionable recommendations to align your policies and reports with new requirements.

- GIPS standards consulting and verification: We can provide internal and external assurance with GIPS compliance consulting and verification. Verification is conducted on an annual basis looking at the prior periods as required by the GIPS Standards for Verifiers.

Reach out to your ACA consultant, or contact us here to learn how we can help you launch, grow, and protect your firm.