Are You FINRA Licensed?

Many asset managers come to us when they find out they can no longer rely on the issuer exemption and are faced with the dilemma of their staff promoting their funds.

The issuer exemption

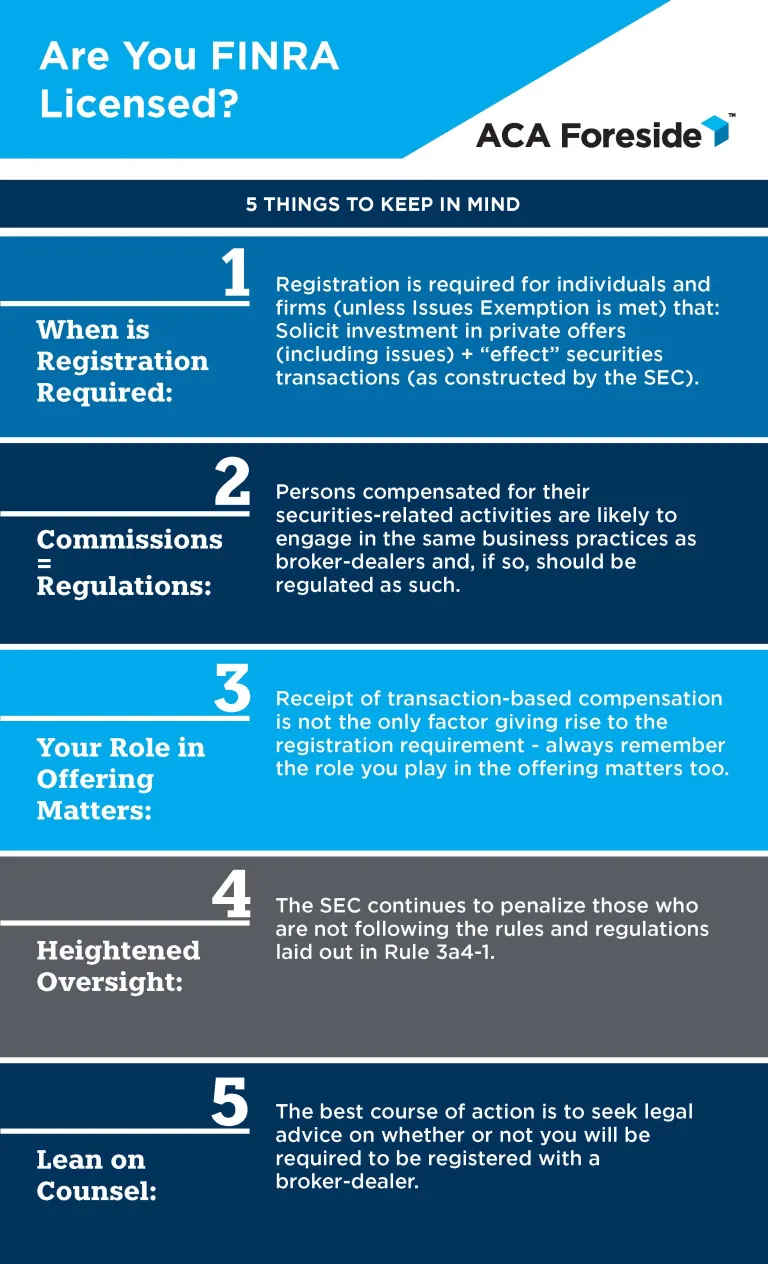

As you may know, the issuer exemption generally applies to employees of the asset manager that sponsors the private fund, or, in other words, employees of the issuer. Broker-dealer registration and Financial Industry Regulatory Authority (FINRA) licensing of employees applies to firms that cannot rely on the issuer exemption. Considerations for registration include, but are not limited to, the active solicitation of investors or receiving commission-based compensation based on the employee’s promotional efforts.

Who must consider getting FINRA licensed?

Section 15(a)(1) of the Securities Exchange Act of 1934 provides that it is unlawful for any broker or dealer to make use of the mails or means or instrumentalities of interstate commerce to effect transactions in any security, or to induce or attempt to induce the purchase or promotion of any security unless said person is properly licensed with a Securities and Exchange Commission (SEC) registered broker-dealer firm that is also a member of a self-regulatory organization (SRO). Said another way, FINRA license registration is not only necessary when securities are bought and sold, but also when an individual is facilitating, assisting, or inducing the promotion of a security.

Do individuals that wholesale securities products to other broker-dealers need to be registered?

Yes. You must register with a FINRA member broker-dealer to function as a wholesaler because you will offer securities to other FINRA member firms. (FINRA Rule 1210)

Do individuals only promoting exempt securities need to be registered with FINRA?

Yes. The terms "Exempt Securities" and "Exempt Transactions" mean these particular securities or transactions (private placements or intrastate offerings) are exempt from the filing requirements of the Securities Act of 1933. Anyone dealing with Exempt Securities and/or Exempt Transactions, however, must register.

Does an individual need to register if they are participating in a capital raise?

The broker-dealer registration issue commonly arises when a company or private investment fund raises capital from investors in a private (unregistered) securities offering using its own employees or third-party “finders” to locate investors. When these individuals solicit investors on a regular basis or are specifically compensated for their efforts (e.g., paid a commission), they may be required to register as a broker or to be associated with a registered broker-dealer firm.

Registration requirements and payments to unregistered persons

FINRA Rule 1210 requires that each person engaged in the investment banking or securities business of a member firm register with FINRA, either as a representative or principal in each category of registration appropriate to his or her functions and responsibilities as specified in FINRA Rule 1220 (Registration Categories). FINRA Rule 1210 also provides that such person is not qualified to function in any registered capacity other than that for which the person is registered, unless otherwise stated in the rules.

Further, FINRA Rule 2040 seeks to align broker-dealer activity with Section 15(a) of the Exchange Act by clarifying that broker-dealers, with limited exceptions are unable to pay transaction-based compensation to any unregistered person or entity.

What are next steps?

Engage with legal counsel to understand and analyze your firm's promotional activities and the risks posed by not being FINRA licensed. ACA Foreside can also help you understand how we are positioned to support your efforts as you broaden your investor base.

How we help

You may not need to create an affiliated broker-dealer. ACA Foreside, through its limited purpose broker-dealers, is positioned as an elite partner to hold your promotional staff’s FINRA licenses and oversee their activities from a compliance perspective. Holding over 2,000 Rep licenses across 300 managers, ACA Foreside enables the compliant marketing of Private Funds, UCITs, ETFs, Mutual Funds and Interval/Tender Funds.

Our clients find enabling their staff via our Registered Representative Licensing services opens doors to broaden their investor base.

Reach out to your ACA consultant, or contact us here to find out more about our Registered Representative Licensing services.