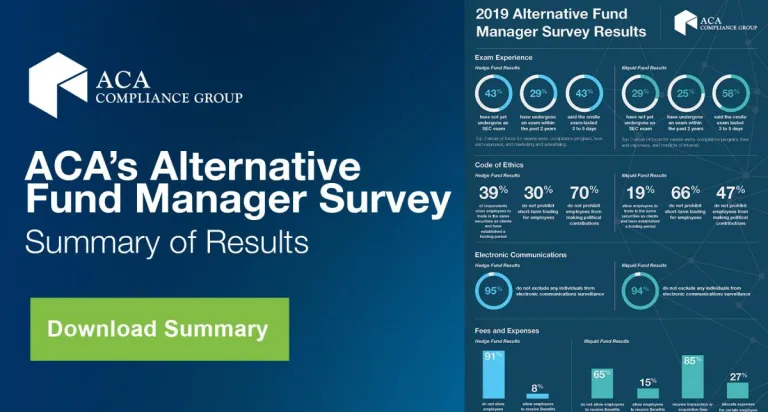

2019 Alternative Fund Manager Compliance Survey Results

As we close out the year, we wanted to reflect back on ACA’s twelfth annual survey in a series that focuses on the novel and complex issues facing hedge fund and illiquid fund (e.g., private equity, real estate, venture, and infrastructure) managers.

Firms of all levels of experience responded with 22% of hedge fund and 12% of illiquid fund respondents being relatively new firms with 1 to 5 years in business, 66% of hedge fund and 71% of illiquid fund respondents being established firms with 6 to 25 years in business, and the remaining respondents being in business for more than 25 years. 17 % of hedge fund respondents have no dedicated compliance staff while only 9% of the illiquid fund respondents do not have a dedicated compliance staff.

Topics covered in the survey included:

- SEC Exams

- Code of Ethics

- Senior Advisors

- Electronic Communications

- Fees and Expenses

- Annual Investor Meeting

- Investment Research Process

- Compliance Program

- Privacy and Cybersecurity

- Valuation

- Marketing / Investor Relations

- Custody

- Key Findings

Download our infographic for some notable findings from the survey.

Complete Results

The complete results were discussed on a live broadcast for survey participants during which the presenters analyzed the issues raised in the survey related to frequently asked questions and provide best practice tips based on our professional analysis of the information collected. Contact ACA's Webcast Team for access to these webcasts.

For More Information

If you have questions about the survey or would like more information about how ACA can help enhance or strengthen your compliance program, please reach out to your ACA consultant or contact us here.