RiskMutation™ Strategic Roadmap: Integrating RegTech

For financial services firms, RiskMutation™ is accelerating the modernization of risk and compliance management. To effectively manage RiskMutation, firms need agility, scalability, and resilience so they can quickly adapt to circumstances and successfully seize opportunities while mitigating continuously evolving risks.

To successfully navigate the future of risk and compliance in the age of RiskMutation, ACA recommends that risk and compliance leaders adopt the following three strategies:

- RegTech: Leverage regulatory technology (RegTech) to transform risk and compliance functions while delivering cost savings

- Outsourcing: Achieve better results, increased agility, and scale for less

- Operational Resilience: Build operational resilience to manage cyber threats, business disruption, and third-party risk across the enterprise and beyond

The business case for RegTech

In contrast to the regulators’ sophisticated technological capabilities, many risk and compliance officers today are burdened with manual and repetitive operational tasks and rudimentary capabilities to identify, manage, monitor, and remediate potential risk and compliance issues. Simply “keeping the lights on” requires manual task management for trading oversight, communications reviews, marketing document reviews, and gift and expense approvals, among other things. However, RegTech designed for risk and compliance officers is quickly catching up to the supervision technology (SupTech) that regulators are using.

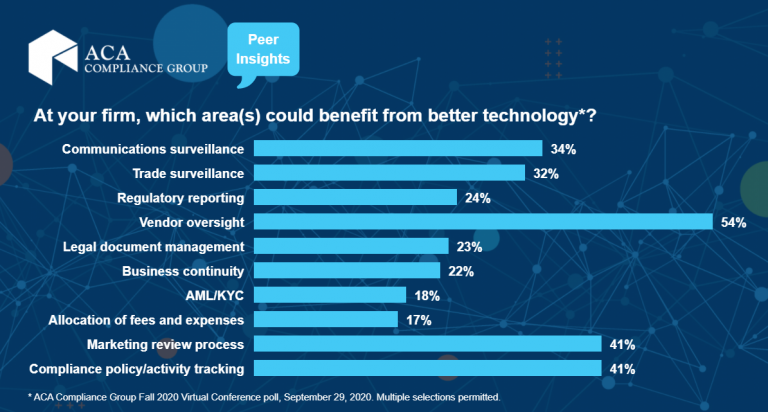

We asked attendees of ACA's recent Fall 2020 Compliance Conference which area(s) at their firm could benefit from better technology*. Here's what they said.

(*Respondents were allowed to select multiple options.)

Achieving efficiencies with RegTech in the age of RiskMutation

Our recent white paper, The Future of Risk and Compliance in the Age of RiskMutation, discusses RegTech in detail and provides concrete action steps and guidance for investment management firms. It discusses:

- The benefits of RegTech

- The business case for investing in RegTech

- Case studies illustrating the ROI for investing in RegTech using real ACA client scenarios

- The strategic roadmap for implementing RegTech

Watch the fall conference session on demand

Watch the on-demand recording of the session The Future of Risk and Compliance in the Age of Risk Mutation from ACA's Fall 2020 Virtual Conference here.

About the Author

Raj Bakhru

Raj Bakhru is a Partner and the Chief Innovation Officer at ACA Compliance Group. In this role, Raj oversees ACA strategy, M&A, and its RegTech software platform, ComplianceAlpha®. Previously, he was the co-founder and Division Head of ACA Aponix®, the cybersecurity and IT risk division of ACA Compliance Group.

Prior to ACA’s acquisition of the firm, Raj was Chief Executive Officer of Aponix Financial Technologists. Before that, he led firm-wide software development and was part of the founding team at Kepos Capital, now a $3 billion global macro quantitative asset manager. Prior to Kepos, Raj served as a Vice President at Highbridge Capital, where he led the team building the firm’s proprietary order and execution management system. In addition, he previously worked on research and cross-asset-class algorithmic trading algorithms and software systems at Goldman Sachs Asset Management’s quantitative hedge funds.

Over the course of his career, Raj has been quoted in the Wall Street Journal, Ignites, HFMWeek, MarketWatch, The Private Equity Law Report, and other industry-leading publications on information security in financial services.

Raj earned his Bachelor of Science degree in Computer Engineering from Columbia University and has received his CFA charter and his CISSP designation.